The Greatest Guide To Insurance Commission

Wiki Article

The Ultimate Guide To Insurance Asia Awards

Table of ContentsSome Ideas on Insurance Quotes You Should KnowSee This Report about Insurance AccountNot known Details About Insurance Ads Unknown Facts About Insurance CommissionFacts About Insurance Asia Awards UncoveredInsurance Expense Things To Know Before You Get This

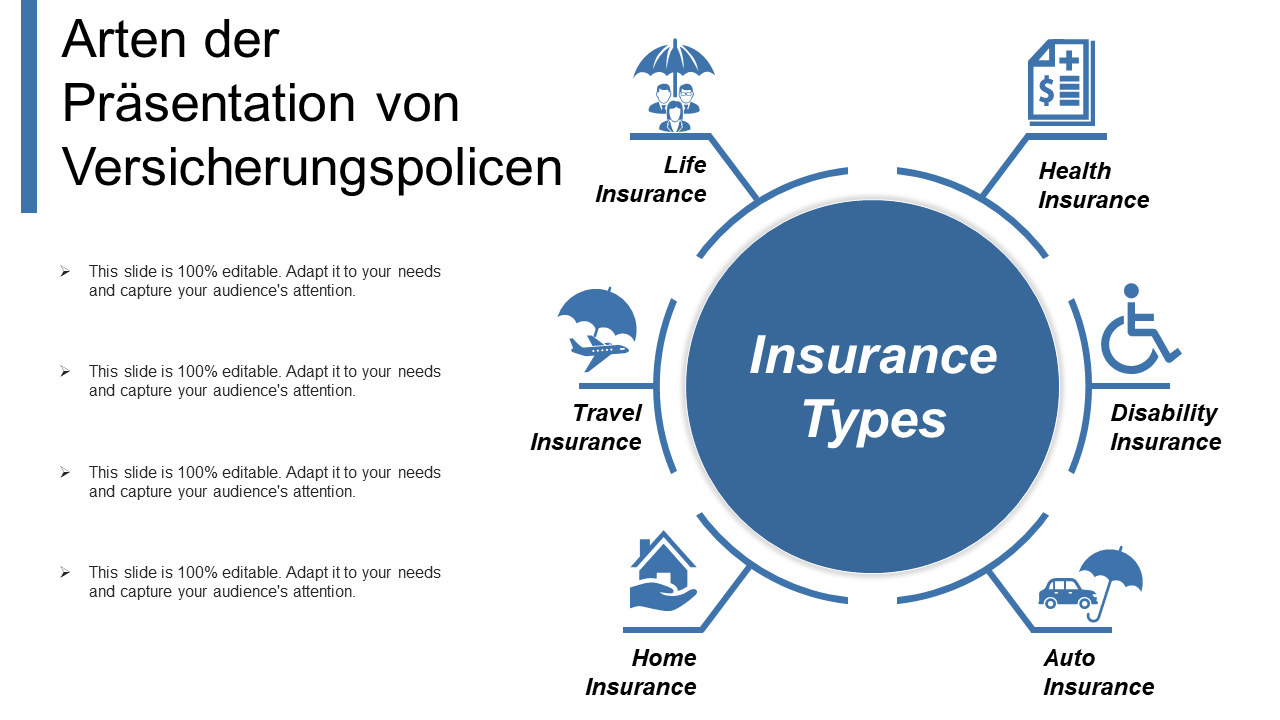

Insurance policy supplies assurance versus the unexpected. You can discover a policy to cover nearly anything, however some are more crucial than others. It all depends on your needs. As you map out your future, these 4 types of insurance coverage must be securely on your radar. 1. Vehicle Insurance policy Vehicle insurance coverage is important if you drive.Some states additionally need you to bring injury security (PIP) and/or without insurance motorist protection. These insurance coverages spend for clinical expenditures associated with the event for you and your passengers, no issue who is at mistake. This likewise aids cover hit-and-run mishaps and accidents with chauffeurs that do not have insurance policy.

If you don't acquire your own, your lending institution can get it for you as well as send you the bill. This may come at a greater expense and also with much less protection. Residence insurance is a great concept also if you've repaid your home loan. That's since it shields you against expenditures for home damage.

The smart Trick of Insurance Agent That Nobody is Discussing

In case of a theft, fire, or disaster, your occupant's policy ought to cover the majority of the costs. It may additionally aid you pay if you need to remain elsewhere while your residence is being repaired. Plus, like residence insurance coverage, occupants offers obligation security. 3. Health Insurance policy Wellness insurance coverage is just one of one of the most essential types.

Some Known Details About Insurance Account

You Might Want Impairment Insurance Policy Too "Contrary to what lots of people think, their house or vehicle is not their greatest property. Rather, it is their ability to earn an income. Several experts do not guarantee the opportunity of a special needs," claimed John Barnes, CFP and proprietor of My Family Life Insurance Coverage, in an email to The Equilibrium.Yet you should Find Out More likewise consider your requirements. Talk with licensed representatives to figure out the most effective ways to make these policies help you. Financial organizers can give recommendations concerning other typical kinds of insurance coverage that need to also be part of your financial plan.

Health Insurance What does it cover? Wellness insurance coverage is probably the most important type of insurance.

The Single Strategy To Use For Insurance Commission

You possibly don't need it if Every grownup need to have health insurance policy. Children are generally covered under among their parents' strategies. 2. Vehicle Insurance coverage What does it cover? There are several various kinds of car insurance policy that cover different scenarios, including: Obligation: Obligation insurance policy can be found in two types: physical injury and property damages liability.Accident Security: This kind of explanation coverage will certainly cover clinical expenses associated with vehicle driver and also guest injuries. Crash: Crash insurance policy will cover the expense of the damage to your automobile if you enter into a crash, whether you're at mistake or not. Comprehensive: Whereas accident insurance just covers damage to your auto triggered by an accident, thorough insurance covers any car-related damages, whether it's a tree falling on your automobile or vandalism from unruly area children, as an example.

There are plenty of discounts you might be eligible for to decrease your month-to-month bill, consisting of safe motorist, wed driver, as well as multi-car discounts. Do you require it? Every state requires you to have vehicle insurance coverage if you're going to drive a car.

Insurance Ads Can Be Fun For Anyone

You probably do not require it if If you do not own a lorry or have a motorist's permit, you will not require car insurance coverage. 3. House Owners or Renters Insurance Policy What does it cover? Home owners insurance coverage covers your house versus damages and also theft, as well as various other perils such as damages to a site visitors residential property, or any kind of prices if someone was wounded on your residential or commercial property.You may require additional insurance policy to cover all-natural disasters, like flooding, quakes, as well as wildfires. Occupants insurance policy covers you against damages or theft of personal items in a house, and also in some situations, your cars and truck. It additionally covers liability costs if somebody was harmed in your apartment or if their personal belongings were damaged or taken from your home.

Do you need it? Property owners insurance is absolutely necessary because a home is usually one's most important asset, and also is usually required by your home mortgage loan provider. Not just is your residence covered, however a lot of your belongings and also individual possessions are covered, also. Renters insurance coverage isn't as critical, unless you have a big house that has plenty of valuables.

insurance asia

Not known Facts About Insurance Expense

Do you need it? Life insurance coverage is the sort of insurance coverage that many people wish to stay clear of considering. It's extremely crucial. If you have a household, you likewise have an obligation to make certain they're attended to on the occasion that you pass in the past your time, particularly if you have youngsters or if you have a partner that's not working.

Report this wiki page